Your Guide to Understanding Drone Insurance Price

- James Baptiste

- Sep 5, 2025

- 15 min read

Updated: Sep 8, 2025

Figuring out the cost of drone insurance isn't like picking an item off a menu. The price can swing wildly, from around $500 a year to over $7,500 annually.

A recreational pilot flying for fun might get a basic liability policy for that lower $500 figure. On the other hand, a commercial business with a whole fleet of expensive, specialized drones could easily be looking at premiums of $7,500 or more. It all boils down to your liability limits, how much your drone is worth, and the kind of flying you do.

Understanding the Landscape of Drone Insurance Costs

There’s no one-size-fits-all price for drone insurance. Think of it like car insurance—it’s a dynamic calculation based entirely on risk. An insurer looks at your specific operation, from the exact model you fly to where you’re flying it, and builds a premium that matches your potential for an accident or loss.

This is why two pilots doing what seems like the same job can get completely different quotes. A real estate photographer using a $2,000 drone over a quiet suburban neighborhood is a much lower risk than an industrial inspector flying a $30,000 thermal drone near a power plant. Getting a handle on this core concept is the first step to estimating what you’ll actually pay.

Key Factors Driving Insurance Premiums

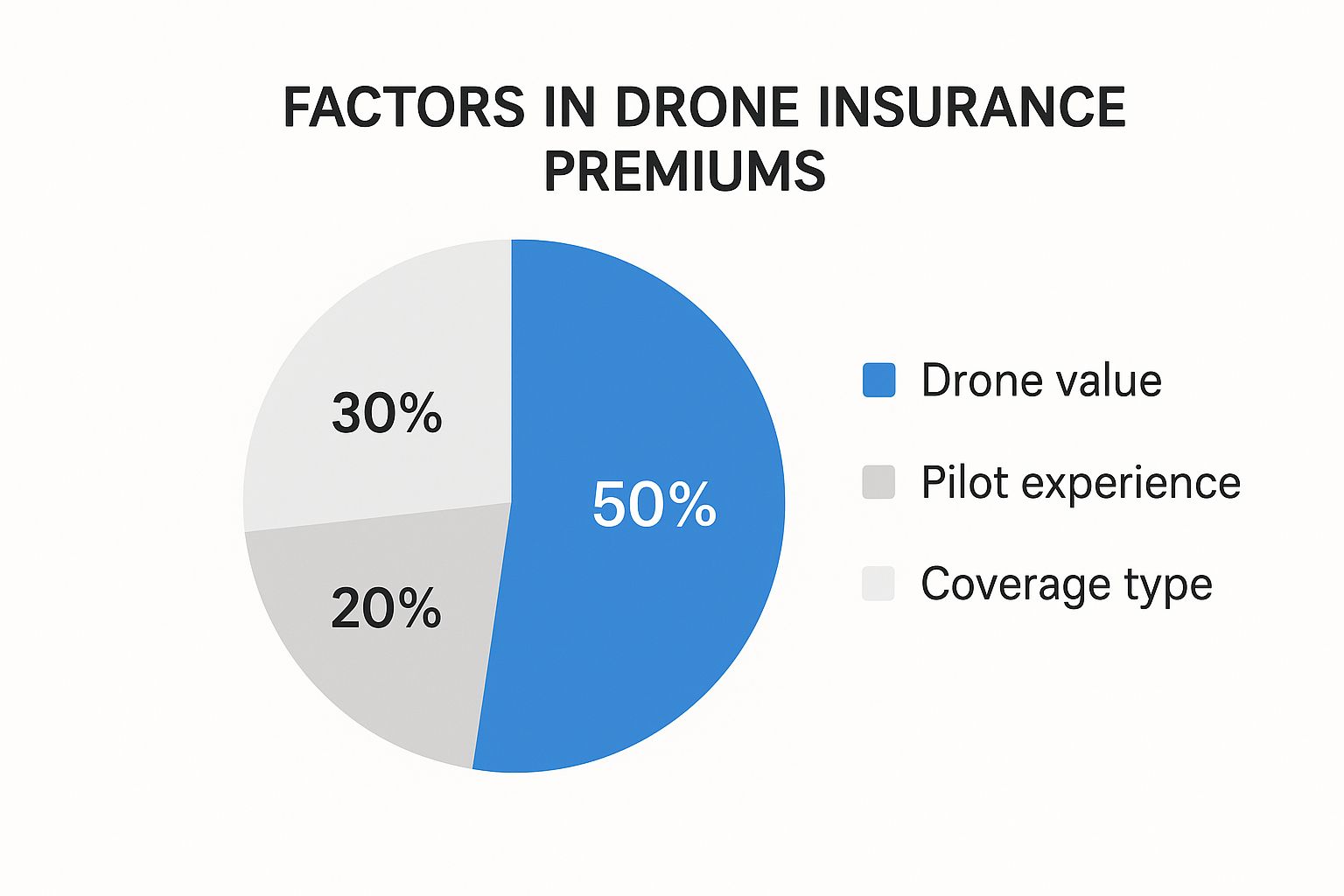

A few key things have the biggest impact on your final premium. While we'll dive deeper into these later, it helps to see how insurers generally weigh these different factors.

This visual breaks down how the three main drivers typically contribute to your total drone insurance price.

As you can see, the value of your drone and its payload is the biggest piece of the pie, making up half the calculation. That makes sense, right? Replacing expensive gear is a major cost for insurance companies. Your experience as a pilot and the specific coverages you choose account for the other half. When thinking about insurance costs, it's sometimes useful to see how other services, like those with theclipbot pricing structures, break down their costs.

A Clear Look at Typical Price Ranges

To give you a better feel for what to expect, I've put together a table with some estimated annual premium ranges for different kinds of drone operators. These are just benchmarks, of course—your final quote will depend on your unique risk factors—but they provide a solid starting point for budgeting.

The table shows pricing for both Liability Only policies (covering damage to others) and combined policies that also include Hull Coverage (covering damage to your drone).

Estimated Annual Drone Insurance Price by Pilot Type

Pilot Type | Typical Liability Coverage | Estimated Annual Price Range (Liability Only) | Estimated Annual Price Range (Liability + Hull) |

|---|---|---|---|

Hobbyist/Recreational | $500,000 | $450 - $600 | $550 - $800 |

Freelancer/Solo Operator | $1,000,000 | $600 - $900 | $750 - $1,500 |

Small Business (1-3 Pilots) | $2,000,000 | $1,200 - $2,500 | $2,000 - $4,500 |

Large Enterprise (Fleet) | $5,000,000+ | $3,500 - $6,000+ | $5,000 - $7,500+ |

It's clear that the price scales up quickly with higher liability limits and the addition of hull coverage. A solo operator can often find a great policy for under $1,000 a year, but a small business needing to protect more valuable gear and satisfy client requirements will naturally see those costs climb.

The Core Factors That Shape Your Premium

Ever wonder why one pilot pays $600 for their annual policy while another in the same city gets a quote for $6,000? It all comes down to the detailed risk assessment every single insurer performs. Getting a handle on these core variables is the first step to understanding your own potential drone insurance price and making smart coverage choices.

Think of it like an underwriter building a risk profile for your specific operation. They aren't just looking at one thing; they're piecing together a mosaic of factors that collectively determine what you'll pay. From the gear you fly to the clients you serve, every detail matters.

Your Drone and Its Payload Value

By far, the single biggest factor driving your premium is the total value of your equipment. This covers the drone itself (often called the hull) and any gear attached to it, like cameras, LiDAR sensors, or gimbals (the payload). An insurer’s main concern here is simple: what would it cost to replace your gear if it gets damaged or destroyed?

It’s just a matter of dollars and cents. A real estate photographer flying a $2,000 DJI drone has a much lower replacement cost than a cinema crew operating a $25,000 heavy-lift rig with a RED camera. The financial exposure for the insurer is worlds apart in that second scenario, which naturally leads to a much higher premium for hull coverage.

An easy way to think about it is this: the more your gear is worth, the more the insurer stands to lose in a claim. Your premium directly reflects that financial risk.

The Liability Limits You Require

Liability coverage is the bedrock of any commercial drone policy. It’s what protects you from the potentially crippling costs of third-party injury or property damage. And as you’d expect, the higher the liability limit you need, the more your drone insurance price will climb.

A $1 million liability limit is a pretty standard starting point for most commercial operators, but plenty of jobs demand much more.

Construction Sites: These clients often demand $2 million to $5 million in liability coverage due to the high value of on-site equipment and the greater potential for accidents.

Film Sets: Major productions might require limits of $5 million or even $10 million to cover the immense risks involving cast, crew, and incredibly expensive set pieces.

Public Events: Flying over a concert or festival could push that requirement even higher because of the obvious risk to large crowds below.

Choosing the right limit is a balancing act. You absolutely need enough to satisfy your client contracts and protect your business, but over-insuring can just needlessly inflate your costs.

Your Industry and Operational Scope

Where you fly and what you do there is just as important as the drone you're using. An insurer is going to take a hard look at the risks baked into your specific line of work. A surveyor mapping remote farmland faces far fewer hazards than a pilot doing facade inspections on a skyscraper in the middle of a bustling city.

The exploding demand for drone services is a key reason this market is growing so fast. The global drone insurance market was valued at USD 1.6 billion in 2023 and is projected to hit around USD 3.5 billion by 2032. That growth is fueled by drones becoming essential tools in fields like agriculture, construction, and delivery—all of which carry their own unique risk profiles. You can dig deeper into this market expansion over at GII Research.

From an underwriter's perspective, certain operations are just inherently higher risk:

Flying Over People: This dramatically increases the potential for injury claims.

Night Operations: Reduced visibility just makes accidents more likely.

BVLOS (Beyond Visual Line of Sight): Operating a drone you can't physically see adds a huge layer of risk.

Proximity to Airports or Critical Infrastructure: Flying in these areas brings serious safety and security implications.

Finally, your own track record plays a huge part. A pilot with a spotless flight log and advanced certifications is a much safer bet than someone with a history of incidents. Getting ahead of these factors and building a strong safety record can directly lower your premium. For more on this, check out our guide on how to reduce your drone insurance cost.

Navigating Your Drone Insurance Coverage Options

Shopping for drone insurance can feel a lot like ordering from a restaurant with a massive menu—it’s easy to get overwhelmed. To land the best drone insurance price, you have to know what you’re actually buying. By breaking down the main coverage types, you can build a policy that fits what you actually do, without paying for extras you’ll never use.

At the heart of it all, drone insurance policies stand on two main pillars: Liability Insurance and Hull Insurance. Think of these as the absolute must-haves, the foundation that protects you from the most common (and costly) risks you’ll face as a pilot.

The Two Pillars of Drone Coverage

First up is Liability Insurance, and for any commercial operator, this is non-negotiable. This is the coverage that kicks in if your drone causes bodily injury or damages someone else's property. If a drone loses signal and smacks into a parked car or—worst-case scenario—injures a bystander, this part of your policy steps in to handle the legal mess and settlement costs. It’s all about protecting your business from accidents that impact others.

The other pillar is Hull Insurance, which is purely about protecting your own gear. This covers the cost to repair or replace your drone if it's damaged in a crash or some other incident. When a sudden gust of wind slams your $5,000 drone into a building, hull coverage is what keeps you from having to buy a new one entirely out of pocket. It’s a direct shield for your investment.

Tailoring Your Policy with Essential Add-Ons

Once you have the foundation sorted, insurers offer specialized add-ons, often called "riders," that let you customize your policy. These are absolutely critical for plugging any gaps in coverage that are specific to your line of work.

Payload Coverage: If you fly with expensive equipment, you need this. Period. Standard hull insurance typically just covers the drone itself, not the pricey thermal camera or LiDAR sensor you have mounted on it. Payload coverage extends protection to that specialized gear. If your $30,000 LiDAR unit is the real star of the show, this add-on is a no-brainer.

Non-Owned Drone Coverage: Ever rent a drone for a specific job or borrow gear from another pro? This covers you when you’re flying a drone that isn't yours. Without it, you could be on the hook for damaging thousands of dollars of equipment you don't even own.

Privacy Liability Coverage: With privacy concerns on the rise, this is quickly becoming essential. This add-on protects you from claims of invasion of privacy—for example, if someone alleges you improperly captured images of them or their property. It’s a modern solution for the data-related risks of aerial work.

Choosing the right mix of coverage is all about matching your policy to your real-world risks. A well-built policy gives you peace of mind, because you know your specific operational hazards are accounted for—from the gear you carry to the places you fly.

Getting a handle on these different components is the key to managing your drone insurance price. For a deeper dive into how these coverages fit together, check out our guide on how drone insurance protects your investment. By selecting only the protection you truly need, you can build a safety net that is both effective and affordable.

Real World Scenarios of Drone Insurance Costs

Numbers on a spreadsheet are one thing, but nothing makes the price of drone insurance click like seeing how it plays out in the real world. To connect the dots between all those risk factors and what you'll actually pay, let's walk through a few detailed scenarios.

Each profile here represents a common type of drone operator, facing their own unique challenges and insurance needs. By seeing how their operations stack up, you can get a much better feel for where your own business might land.

Profile 1: The Freelance Real Estate Photographer

First up is Alex, a solo pilot who makes a living shooting residential real estate. Alex flies a DJI Air 3, a solid workhorse drone that, with extra batteries and filters, is worth around $2,200. The job is pretty low-risk—just flights over quiet suburban homes, usually on clear, sunny days.

Most of Alex’s clients are real estate agents who won't even talk business until they see proof of insurance.

Drone & Payload Value: $2,200

Liability Limit Required: $1,000,000 (this is pretty much the standard for real estate gigs)

Primary Use Case: Aerial photos and videos of single-family homes.

Risk Factors: Low. The flights aren't over crowds or busy city centers.

For a policy that bundles $1 million in liability with hull coverage for the drone itself, Alex is looking at an estimated annual premium of about $850. That price tag directly reflects the low equipment value and the straightforward, low-hazard nature of the work.

Profile 2: The Small Surveying Firm

Next, we have a small surveying firm with two licensed pilots on staff. They operate a DJI Matrice 300 RTK paired with a Zenmuse P1 camera—a serious piece of kit with a total value of $25,000. Their work involves mapping huge tracts of farmland or keeping tabs on progress at rural construction sites.

Even though these areas aren't crowded, the sheer value of that drone is a huge factor for any insurer. On top of that, their client contracts demand higher liability limits to cover any potential accidents on a job site.

Drone & Payload Value: $25,000

Liability Limit Required: $2,000,000

Primary Use Case: Agricultural mapping and construction site monitoring.

Risk Factors: Moderate. The flight environments are often remote, but the high equipment value bumps up the risk profile.

To lock in a $2 million liability policy and get full hull coverage for their expensive gear, the firm pays an estimated annual premium of $3,200. The drone and payload value is the main reason for that much higher price.

This is a perfect example of a core insurance principle: the more an insurer stands to lose in a claim—whether it's from a lawsuit or replacing pricey equipment—the higher your premium is going to be.

Profile 3: The Industrial Inspection Company

Finally, let's look at a large industrial company that uses a whole fleet of drones to inspect power lines and wind turbines. They're flying multiple advanced drones, some with thermal cameras, and their total fleet is worth over $100,000. These operations are inherently high-risk, often taking place near critical infrastructure and sometimes needing special waivers to fly in restricted airspace.

Their corporate clients demand massive liability limits to protect against worst-case scenarios. This high-stakes work is a major reason the drone insurance market exists, though the hefty premiums can be a barrier for some. While the drone services industry is valued around USD 14 billion, the insurance market's growth is a bit slower, partly because of these costs. You can find more on this trend in this market analysis.

Drone & Payload Value: $100,000+

Liability Limit Required: $5,000,000 or more

Primary Use Case: Inspecting high-voltage power lines and wind turbines.

Risk Factors: Very high. We're talking flights near critical, high-value assets.

For their comprehensive fleet coverage with a $5 million liability limit, this company can expect to pay an annual premium of $7,000 or more. It just goes to show how high equipment value, massive liability needs, and high-risk jobs all combine to push insurance costs to the top tier.

Drone Insurance Cost Scenarios

To make these differences even clearer, here's a side-by-side look at how the numbers stack up for our three distinct operators. It really highlights how a few key variables can dramatically change the final premium.

Operator Profile | Drone & Payload Value | Liability Limit | Primary Use Case | Estimated Annual Premium |

|---|---|---|---|---|

Freelance Photographer | $2,200 | $1,000,000 | Real Estate Photos | ~$850 |

Small Surveying Firm | $25,000 | $2,000,000 | Mapping & Surveying | ~$3,200 |

Industrial Inspector | $100,000+ | $5,000,000+ | Critical Infrastructure | ~$7,000+ |

As you can see, there’s no single "cost" for drone insurance. Your premium is a direct reflection of your specific operation—the value of your gear, the limits your clients demand, and the kind of work you do every day.

Actionable Strategies to Lower Your Insurance Costs

While your drone insurance price is a non-negotiable business expense, the final number on the quote isn't set in stone. By taking a few proactive steps to clean up your risk profile, you can directly influence your premiums and find some serious savings without cutting corners on protection. Insurers love to see a safe, professional, and well-documented operator.

Think of it just like getting a good driver discount on your car insurance. The most powerful tool you have for lowering your costs is proving you're a responsible pilot who takes safety seriously. It's about more than just flying well; it's about showing a real commitment to risk mitigation that underwriters can see—and reward.

Bolster Your Credentials and Safety Protocols

The quickest way to signal your professionalism to an insurer is through advanced training and certifications. When you earn credentials that go beyond the basic FAA Part 107 license, it proves you’ve invested in your skills and can handle complex flight operations. This simple step immediately sets you apart as a lower-risk client.

Just as important is keeping meticulous flight and maintenance logs. These documents are your proof. A detailed logbook showcases your experience, demonstrates a history of safe flights, and confirms your equipment is always in top shape. This data gives an underwriter a reason to base their decision on your actual record, not just industry averages.

Here are a few key actions that can lead to lower premiums:

Earn Advanced Certifications: Look into specialized programs for things like thermal imaging, agricultural ops, or public safety.

Implement a Safety Management System (SMS): A formal SMS gives you a structured way to manage risk, which insurers view very favorably.

Maintain Detailed Logs: Use an app or a physical logbook to track every single flight, maintenance check, and battery cycle.

Right-Sizing Your Coverage

One of the most common mistakes drone pilots make is paying for way more coverage than they actually need. It’s tempting to grab the highest liability limit you can find, but this can needlessly inflate your drone insurance price. Instead, take a hard look at your client contracts and typical jobs to figure out a realistic limit.

For example, if you're mostly shooting real estate in quiet rural areas, a $1 million liability policy is often more than enough. You probably don't need the $5 million policy that an industrial inspection crew would carry. For a deeper dive into structuring your policy, check out our detailed guide on **drone business insurance**.

The drone insurance market, valued at around USD 1.44 billion in 2024, shows just how seriously the industry is taking UAV-related risks. And for good reason—drone-related incidents shot up by 130% between January and November 2022 alone, making the right coverage more critical than ever. You can find more insights on this growing market in this comprehensive report.

Choosing the right coverage is a strategic decision. It's all about finding that sweet spot where you're fully protected for the work you actually do, without overpaying for hypothetical, high-risk scenarios you'll never face.

Choose the Right Policy Structure

Finally, think about how you fly. The rise of on-demand insurance apps has created a flexible alternative to traditional annual policies. For pilots who don't fly every day, this "pay-as-you-fly" model can be a total game-changer.

On-Demand Insurance: This is perfect for hobbyists or professionals who only fly a few times a month. You pay for coverage by the hour or by the day, which can be far more budget-friendly than a year-long commitment.

Annual Policies: These are better suited for full-time commercial operators flying multiple times a week. An annual policy provides continuous coverage and usually works out to be more cost-effective for high-frequency flyers.

By matching your policy structure to your flight frequency, you can stop paying for downtime and seriously optimize your insurance spending.

Why Flying Uninsured Is a Costly Gamble

Thinking about skipping drone insurance to save a few hundred bucks? It’s a tempting thought, for sure. But it’s a gamble where the potential losses completely dwarf the minor upfront savings. One little mishap can set off a devastating financial chain reaction, turning a simple job into a business-ending disaster.

Let’s paint a picture. You're hired for a beautiful outdoor wedding, capturing stunning aerials of the ceremony. Then, out of nowhere, you get a signal loss. Your drone spirals down and smashes right onto the hood of the groom's meticulously restored vintage car. The damage isn't just a scratch—it's thousands of dollars in specialized bodywork and paint.

Without insurance, that entire bill lands squarely in your lap.

The Domino Effect of a Single Accident

The initial repair cost is often just the opening act. The real pain comes later, kicking off a cascade of expenses that can quickly spiral out of control. Flying uninsured leaves you wide open to a brutal series of financial hits that a good policy is specifically built to handle.

Let's break down the potential fallout from that wedding crash:

Property Damage Costs: First up is the immediate cost of fixing that luxury car. This could easily be $5,000, $10,000, or even more, depending on the vehicle.

Legal Fees: If the car owner decides to sue—and they probably will—you're suddenly facing attorney fees, court costs, and a potentially huge settlement. Legal fights are notoriously expensive, often costing tens of thousands before you even get close to a resolution.

Equipment Replacement: Your drone is toast. That’s another $2,000 or more right out of your pocket just to replace the gear you need to do your job.

Reputational Damage: Word gets around fast. An incident like this can shatter your professional reputation, leading to a flood of negative reviews and future clients who see you as too risky to hire.

In an instant, a decision to save $800 on an annual policy could blow a $20,000 hole in your finances—and that's not even counting the irreversible harm to your brand. The math just doesn't add up.

This isn’t just about protecting your drone; it's about protecting your entire livelihood. That relatively small drone insurance premium is an investment in your stability and peace of mind. If you're still on the fence, our guide on whether you should get drone insurance dives even deeper into this critical decision.

Ultimately, flying protected is what separates a professional operator from someone taking a reckless financial risk.

Answering Your Top Drone Insurance Questions

When you're getting into drone insurance, a lot of questions pop up, especially around cost and whether you really need it. Let's cut through the noise and get you some straight answers to the questions we hear most often from pilots just like you.

Do I Need Insurance for My Hobby Drone?

Legally? Not always for purely recreational flying. But is it a good idea? Absolutely. Think about it: if your drone glitches out and hits a car or crashes through a neighbor's window, you're on the hook for potentially thousands of dollars in damages. Without insurance, that comes straight out of your pocket.

Plus, it's becoming the new standard. A growing number of parks, flying fields, and local drone clubs now require you to show proof of liability insurance before they'll even let you power up on their property. It’s just smart risk management for everyone involved.

Is On-Demand Insurance Cheaper Than an Annual Policy?

This really boils down to one thing: how much are you flying? For the weekend warrior who only gets their drone up a few times a month, on-demand (or "pay-as-you-fly") insurance can be a real money-saver. You're only paying for the coverage you need, right when you need it.

But if you're running a business or flying several times a week, an annual policy almost always makes more sense. It gives you constant, gap-free coverage and the per-hour cost usually works out to be much lower for frequent flyers.

Choosing between on-demand and annual coverage is a strategic decision. Calculate your average monthly flight hours to see which model offers the better drone insurance price for your specific operational tempo.

Does My Homeowners Insurance Cover My Drone?

This is a big one, so listen up: your homeowners insurance almost certainly does not cover your drone. Standard policies are famous for having specific exclusions for anything classified as an "aircraft," and yes, that includes your UAV.

Even more importantly, they will flat-out deny any claim related to business or commercial use. Trying to rely on your homeowner's policy leaves a massive, financially risky blind spot in your coverage. A dedicated drone policy is the only real way to protect your gear and shield yourself from liability.

At JAB Drone, we believe clear information is a pilot's best tool. For more expert tips, reviews, and insights to help you fly safely and build your business, check out everything we have to offer at https://www.jabdrone.com.

Comments