Your Guide to Drone Liability Coverage

- Jab Media

- Aug 24, 2025

- 16 min read

Think of drone liability coverage like you would car insurance—it's the financial safety net for your drone operations. At its core, this insurance is designed to protect you from the sky-high costs that come with accidents, specifically covering claims from other people for bodily injury or property damage caused by your drone.

Why Drone Liability Coverage is a Professional Necessity

Flying a drone, whether it's for a high-stakes commercial shoot or just as a serious hobbyist, always carries risk. It’s not hard to imagine. A sudden gust of wind could push your drone straight into a building's window, or a lost signal could send it tumbling onto a parked car below.

These aren't just far-fetched "what if" scenarios; they happen, and when they do, they can lead to some seriously expensive legal battles and repair bills. This is exactly where drone liability coverage proves its worth, standing as your first line of defense against a potential financial nightmare.

The Core Purpose of Liability Insurance

This type of insurance is all about managing the risk of incidents you cause to others. It’s important to know that it won’t pay to fix your own drone if you crash it—that’s a different kind of coverage called hull insurance. Liability insurance is laser-focused on protecting you from accidents involving third parties.

Its main jobs are to:

Cover Property Damage: This pays to repair or replace someone else's property if your drone damages it. Think breaking a window, denting a car roof, or damaging sensitive equipment during an industrial inspection.

Cover Bodily Injury: If your drone accidentally hurts someone, this coverage helps with their medical bills, potential lost income, and other related costs.

Handle Legal Fees: If a claim turns into a lawsuit, your policy can cover the often staggering costs of a legal defense, settlements, and any judgments made against you.

One of the biggest mistakes pilots make is assuming their homeowner's or general business insurance has them covered. The truth is, most standard policies have specific exclusions for aircraft, including drones, which makes dedicated coverage an absolute must.

From Good Idea to Essential Tool

The need for drone liability insurance has grown right alongside the drone industry itself. With more and more drones taking to the skies for photography, surveying, and inspections, the chances of an accident naturally go up.

Because of this, many clients today won't even consider hiring a pilot who can't show a Certificate of Insurance (COI) as proof of adequate liability protection. For anyone on the fence, figuring out if you should get drone insurance is a crucial first step. It’s no longer just a smart precaution; it's a fundamental requirement for operating legally and professionally. It protects your bank account, but just as importantly, it protects your business's reputation and credibility in a crowded market.

Getting to Grips with Different Drone Insurance Policies

Diving into the world of drone insurance can feel a bit like comparing apples to oranges at first. Not every policy is created equal, and what works for a weekend hobbyist is almost never the right call for a full-time aerial surveyor. The key is understanding the different ways these policies are structured so you get the protection you actually need—without paying for stuff you'll never use.

You’ll mainly run into two flavors of policies: on-demand (or pay-per-flight) insurance and annual policies. The easiest way to think about it is like choosing how to get around town. On-demand insurance is like buying a single bus ticket for one specific trip. An annual policy? That's your yearly transit pass for unlimited rides.

On-Demand vs. Annual Policies

For pilots who only fly now and then—maybe for a handful of real estate gigs each month—on-demand insurance is a game-changer. It offers incredible flexibility, letting you switch on your coverage for a specific block of time, like just an hour or a full day, usually right from an app. This model is perfect for keeping your overhead low when your flight schedule is all over the place.

On the other hand, if you're a professional pilot who's up in the air multiple times a week, an annual policy is almost always going to be the smarter financial move. These plans give you nonstop coverage, so you never have to remember to activate insurance before a flight. It provides serious peace of mind and, for high-frequency operators, it’s just plain more cost-effective.

This need for both flexible and rock-solid insurance options is a direct reflection of just how fast the drone industry is growing. The global market for drone insurance was already valued at $1.2 billion in 2023, and experts project it will skyrocket to $4.8 billion by 2033. This explosion shows just how critical proper coverage has become in fields like construction and agriculture, where drones are now everyday tools. You can dig into more of the numbers on the growing drone insurance market here.

Decoding Your Liability Limits

One of the biggest decisions you'll face is picking a liability limit. This number represents the absolute maximum your insurance provider will pay out if you have a covered claim. Common options start around $500,000 and can go up to over $5 million. The right number for you boils down entirely to your personal risk profile.

A photographer shooting a wedding in a wide-open park might feel perfectly safe with a $1 million limit. But a pilot inspecting a multi-million dollar solar farm or flying near a crowded festival? They'll likely need $5 million or more, not just to cover the massive potential for damage but also to meet their client's contractual requirements.

Key Takeaway: Your liability limit shouldn't be a random guess. It needs to be a calculated choice based on where you typically fly, the value of the property below, and what your clients are demanding in their contracts.

Looking Beyond Liability: Essential Add-Ons

While drone liability coverage is the foundation of any good policy, it only protects you from claims made by other people. It does absolutely nothing for your expensive gear. That’s where a couple of crucial add-ons come into the picture.

Two of the most important ones to consider are:

Hull Insurance: This is the policy that repairs or replaces your drone if it gets damaged or disappears in an accident. Whether it’s a crash, a flyaway, or an unfortunate dip in a lake, hull insurance protects your actual physical investment in the drone itself.

Payload Coverage: Your drone might be valuable, but that high-end thermal camera or cinema-grade lens it's carrying could easily be worth more. Payload insurance is designed specifically to cover this attached equipment, which is almost always excluded from a standard hull policy.

Choosing the right policy isn't about finding the cheapest price tag. It's about taking a clear, honest look at how often you fly, where you fly, and what gear you simply can't afford to lose. By balancing the flexibility of on-demand plans with the robust security of an annual policy and picking the right limits and add-ons, you can build an insurance strategy that truly protects your business.

What Your Drone Insurance Actually Covers

So, you’ve got a policy, but what does that piece of paper really do for you? Understanding your drone liability coverage means digging into the details to see what’s covered and—just as importantly—what’s not. Think of it less like a blanket guarantee and more like a specific agreement for certain situations.

Let's walk through some real-world scenarios to see how this plays out. Every solid liability policy is built to handle two core risks: damaging someone's stuff and injuring someone.

The Core Protections in Your Policy

Imagine you're a real estate photographer getting those perfect aerial shots of a luxury home. A sudden gust of wind or an unexpected signal drop sends your drone into a massive, custom-made window. That's a classic case of property damage. Your liability coverage is designed to step in and handle the bill for that replacement, saving you from a potentially business-ending expense.

Now, picture yourself filming a wedding in a park. While you're maneuvering for that perfect overhead shot of the ceremony, a motor fails, and the drone comes down, clipping a guest on the arm. This is where bodily injury liability comes into play. Your insurance would help cover the guest's medical bills and any other related costs, preventing a simple accident from spiraling into a nasty legal battle.

Beyond physical damage, most modern policies add another critical layer of protection.

This is often called personal and advertising injury coverage. It’s your shield against claims for less tangible things, like someone suing you for invasion of privacy, slander, or even copyright infringement because of the footage you captured.

For instance, if a neighbor claims your drone filmed into their backyard and decides to take you to court, this is the part of your policy that would kick in to cover your legal defense. For any pilot who shares their work online or for clients, this is an absolute must-have.

Common Exclusions That Can Void Your Coverage

Knowing what’s covered is only half the story. It's just as crucial to understand what isn't. Your insurance policy isn't a blank check; it's a contract with rules. Break those rules, and you could find yourself without any coverage right when you need it most.

Here are a few of the most common ways pilots accidentally void their coverage:

Illegal or Reckless Flying: Flying in restricted airspace, buzzing over crowds in violation of FAA rules, or operating under the influence are instant deal-breakers for an insurer. A claim from any illegal flight will almost certainly be denied.

Intentional Acts: Liability insurance is for accidents, period. If you intentionally use your drone to damage property or harass someone, you’re on your own. It sounds obvious, but it’s a foundational exclusion in every policy.

Uncertified Operations: If you’re flying commercially, you need the right FAA credentials, like a Part 107 license. If you’re not certified to fly for business, your insurer has every right to deny a claim that happens on a paid job.

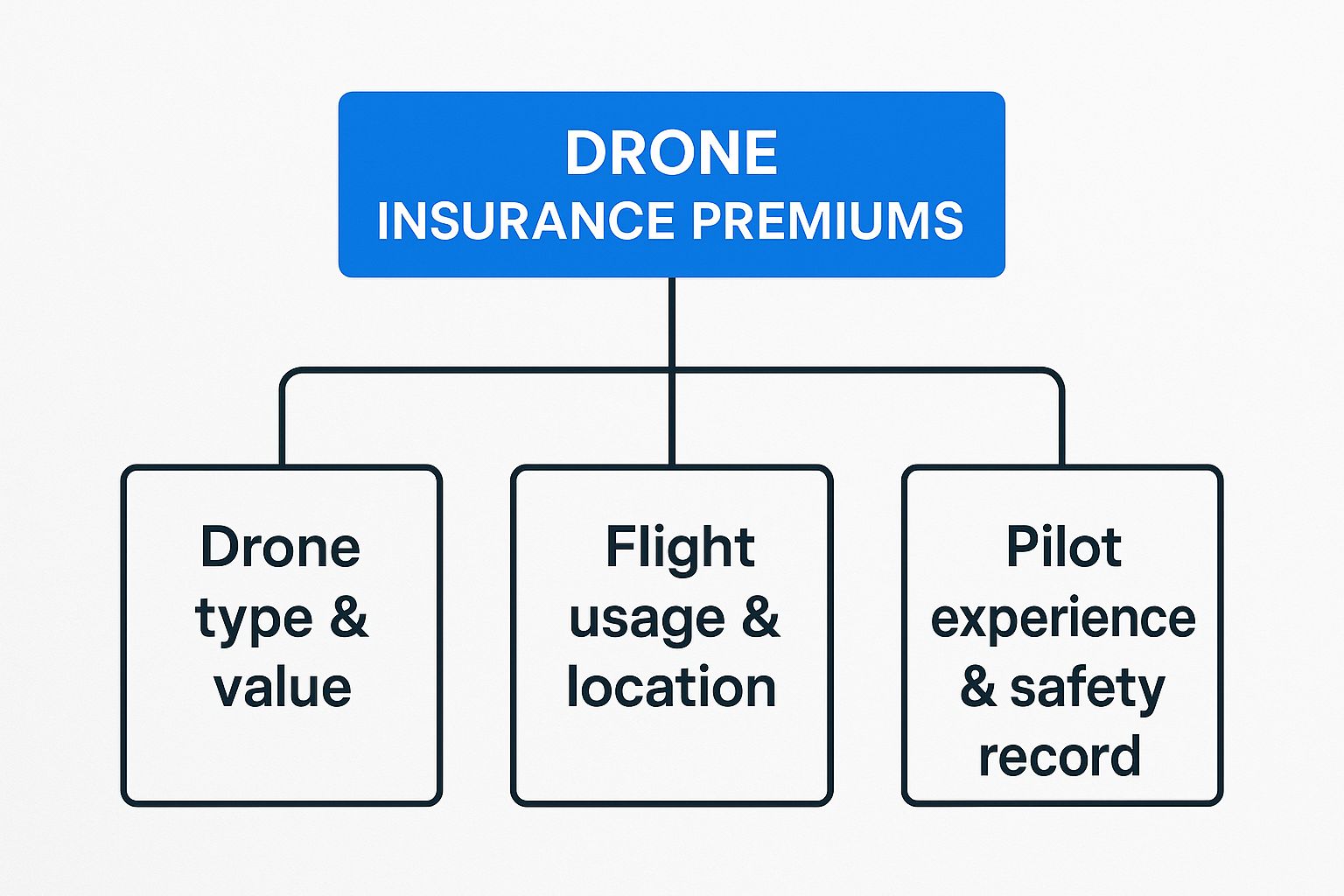

To give you a better idea of how insurers think, this chart breaks down the main factors they look at when deciding on your premium. It all comes down to risk.

As you can see, your insurance cost is a direct reflection of how much your drone is worth, the kind of flying you do, and your track record as a safe, responsible pilot.

To help clarify what a typical policy looks like, here's a quick breakdown of what you can usually expect to be included versus what's often left out.

Standard Drone Liability Policy Coverage Breakdown

Coverage Aspect | Typically Included | Commonly Excluded |

|---|---|---|

Third-Party Bodily Injury | Medical expenses for non-crew members injured by your drone. | Injuries to the pilot or crew operating the drone. |

Third-Party Property Damage | Repair or replacement costs for property damaged by your drone. | Damage to your own drone or equipment (this is hull insurance). |

Personal & Advertising Injury | Legal defense for claims of privacy invasion, slander, or libel. | Intentional acts of defamation or copyright infringement. |

Geographic Scope | Operations within the specified country (e.g., United States). | Flights in international airspace without a specific endorsement. |

Legal Compliance | Flights that adhere to all local and federal aviation regulations. | Any operations that are illegal, reckless, or uncertified. |

Ultimately, the only way to be 100% sure about your coverage is to read your policy documents from top to bottom. Every pilot has different needs, and a deeper dive into how drone insurance is explained can help protect your investment by making sure you get the right coverage from day one. A good policy is one that’s built around your specific operations, giving you true peace of mind every time you fly.

How Drone Insurance Premiums Are Calculated

Ever look at a drone insurance quote and wonder where that number came from? It’s not just pulled out of thin air. Insurers are essentially making an educated guess on the likelihood of an accident, much like they do for car insurance.

They piece together a puzzle based on several key factors to build your unique risk profile. The good news? Once you understand what they’re looking at, you have some control over the final picture—and the price tag.

The Drone Itself Matters

First things first, the insurer wants to know about your gear. There’s a world of difference between a lightweight quadcopter for taking a few photos and a heavy-lift industrial drone carrying thousands of dollars in sensors. The financial risk just isn't the same.

Insurers will zero in on a few specifics:

Make and Model: A high-end, expensive drone simply costs more to insure. A $10,000 surveying rig represents a much bigger potential loss than a $500 hobbyist model if something goes wrong.

Weight: This is a big one. Heavier drones can cause a lot more damage if they fall out of the sky, so the drone’s takeoff weight is a major part of the risk calculation.

Payload: What are you attaching to the drone? The value of that thermal camera or LiDAR sensor you’re flying matters, especially if you’re getting payload coverage.

Your Flight Operations and Location

Where and how you fly might be the single most important piece of the puzzle. Insurers need to understand the context of your flights because that directly translates to the chance of an incident involving people or property on the ground.

Think about two different pilots. One shoots real estate videos over empty suburban yards in broad daylight. The other performs inspections near active power lines or buzzing construction sites. It’s pretty clear who is going to pay more for their drone liability coverage.

The Bottom Line: Your premium is a direct reflection of your operational risk. Flying in crowded urban areas, near airports, or over critical infrastructure will always command higher insurance costs than flying in open, rural spaces.

This is an area where the insurance industry is getting much smarter. Many providers are now using sophisticated models that analyze flight patterns and pilot behavior to price liability more accurately. It's what has opened the door for flexible, on-demand policies that are a better fit for how drones are actually used. You can learn more about how these modern drone insurance models are changing the game.

The Pilot's Experience and Safety Record

Finally, it comes down to the person holding the controls. Just like with your car insurance, a clean track record and solid experience can really work in your favor. Insurers are looking for signs that you’re a responsible operator who knows how to minimize risk.

They’ll look at factors like:

Flight Hours: More time in the air usually means you’re more proficient, which can help lower your premium.

Certifications: Having an FAA Part 107 certificate is the standard for commercial pilots, but any advanced training or specialized certifications you have can make you look like a safer bet.

Claims History: This one’s obvious. A history of accidents or claims will almost always mean a higher premium. A spotless safety record is your best friend here.

By actively managing these areas—using the right drone for the job, planning safe flight paths, and constantly building your skills—you present a much stronger profile to insurers. If you’re serious about getting the best rates, taking these steps is the best way to reduce your drone insurance cost.

Meeting Legal and Client Insurance Demands

In the world of commercial drone operations, flying without drone liability coverage isn't just a gamble—it's often a complete non-starter. Insurance has rapidly evolved from a "nice-to-have" safety net into a hard requirement, pushed by two major forces: government rules and, more importantly, client demands. If you can't meet these standards, your drone business might be grounded before it even gets off the launchpad.

Aviation authorities across the globe, like the Federal Aviation Administration (FAA) here in the U.S., are tasked with keeping the skies safe. While the FAA doesn't force every single commercial pilot to carry insurance, many specific operations, state laws, or special waivers make it a legal must-have. As drones become more integrated into daily life, regulators are starting to treat them just like any other aircraft, where professional liability protection is the bare minimum.

But let's be honest, the most powerful push for insurance comes directly from the people who hire you.

Why Clients Will Not Hire You Without Insurance

Put yourself in the shoes of a project manager for a huge construction company or a producer on a film set. You need that perfect aerial shot, but you're also juggling immense financial risk. The absolute last thing you need is a drone crashing, causing thousands in damages or injuring someone, only to discover the pilot has no way to cover the costs.

This is exactly why serious clients won't even look at a contract until they've seen your Certificate of Insurance (COI). Think of this one-page document as your golden ticket. It's the proof that you have an active and adequate liability policy.

A Certificate of Insurance is more than just a piece of paper; it's a professional credential. It signals to potential clients that you're a serious, responsible operator who has taken the right steps to protect their interests as well as your own.

Clients in high-stakes industries like event management, industrial inspections, and real estate development view an uninsured pilot as an unacceptable risk. To get a fuller picture of how insurance acts as the backbone of a successful drone company, check out our complete guide to drone business insurance.

Understanding the Additional Insured Requirement

Smart clients don't stop there—they take their protection one step further. It's very common for them to require you to list their company as an "additional insured" on your policy for the project's duration.

This is a critical detail. What it means is that if an accident happens and someone files a lawsuit, your insurance policy will step in to protect them, too. For the client, it’s a direct line of defense that shields them from being held financially responsible for something that was ultimately your mistake. If a pilot can't or won't add a client as an additional insured, it's almost always an immediate deal-breaker.

The industry data backs this up. Liability coverage is the dominant force in the drone insurance market and is expected to stay there, driven by accident rates and increasingly strict rules. For example, North America was on track to account for nearly 40% of the global drone insurance revenue in 2024, which speaks volumes about the region's firm stance on insurance. The need for robust liability coverage isn't unique to drones; you can see similar risk management principles in fields like landscape liability insurance.

How to Choose the Right Drone Liability Policy

Picking the right drone liability coverage isn’t like grabbing a product off a shelf. It's an active process of finding the right policy that fits how you operate. Think of it as investing in a custom-fitted safety net for your business, not just buying a generic insurance plan.

The first step is a good, hard look at your own risks. Don't just think about the drone itself; consider the entire environment you fly in. Are you snapping photos of real estate in quiet suburbs? Or are you navigating a busy industrial site with millions of dollars of equipment on the ground? The answers to these questions will point you toward the liability limits and policy type that actually make sense for you.

Gather and Compare Quotes Strategically

Once you have a handle on your risks, it’s time to go shopping. Never, ever take the first quote you get. Your goal should be to get proposals from at least three different insurers, preferably ones that specialize in aviation or drone coverage. This isn't just about chasing the lowest price—it's about understanding what you're actually getting for your money.

As you compare the quotes, make a simple chart to see everything side-by-side:

Liability Limit: How much will they cover for property damage or bodily injury?

Annual Premium: What's the total yearly cost?

Deductible Amount: If something happens, how much do you have to pay first before the insurance kicks in?

Key Exclusions: What specific situations will they not cover? This is a big one.

This little bit of homework will quickly show you who’s offering the most real value. And the good news is, your options are growing. The drone liability insurance market is expected to hit around $85 million by 2033, growing at a rate of 8.1% each year starting in 2025. More competition means better choices for pilots who are willing to look. You can read more about the growth of drone liability insurance here.

Dig Into the Policy Details

The quote shows you the highlights, but the actual policy document has all the critical details. This is where you need to put on your reading glasses and dive into the fine print, especially the exclusions section. Look for clauses about flying over crowds, operating beyond visual line of sight (BVLOS), or using any non-factory gear on your drone.

Don't be afraid to ask questions. A good insurance provider will be more than happy to walk you through any confusing terms to make sure you know exactly what’s covered—and what isn’t—before you sign anything.

Finally, do a quick check on the insurer's reputation. A cheap premium is worthless if the company ghosts you when it's time to file a claim. Search for online reviews, ask for testimonials, or see what other pilots are saying in forums. An insurer with a solid reputation for paying claims fairly and quickly is worth its weight in gold.

Common Questions About Drone Liability Coverage

Figuring out the world of drone liability coverage can definitely bring up a lot of questions. It's a balancing act between staying safe, meeting legal requirements, and not breaking the bank. Let’s clear the air and tackle some of the most common questions pilots like you are asking.

The idea here is simple: get you quick, reliable answers that cut through the noise so you can fly with more confidence.

Do I Need Insurance for Recreational Flying?

This is easily the question I hear most often, and the short answer is: it depends, but you probably should have it. While the FAA doesn't force recreational pilots to carry liability insurance, you are 100% legally responsible for any damage or injury your drone causes.

Think about it. Your drone loses connection and takes out a neighbor’s expensive glass patio table. Without a dedicated policy, that replacement cost is coming straight out of your pocket. Many people assume their homeowner's policy will cover it, but most plans specifically exclude aircraft—and yes, that includes your drone. A specific drone policy is really the only way to be sure you're protected from a costly mishap, even if you’re just flying for fun.

Even when it’s not legally required for hobbyists, getting drone liability coverage is just a smart financial move. A small accident can easily rack up thousands of dollars in damages, which is way more than the cost of a basic annual policy.

How Much Liability Coverage Is Enough for My Business?

For commercial pilots, it's not a question of if you need insurance, but how much. The industry standard for most commercial drone jobs is a $1 million liability limit. For things like real estate photography or small marketing shoots, this is usually plenty.

But your coverage has to match your risk. If you’re flying in more complex or high-stakes environments, you'll need to step it up.

Construction Sites: Flying around heavy machinery and critical infrastructure? Clients will often require limits between $2 million to $5 million.

Film Sets or Large Events: With lots of people and expensive gear on the ground, expect clients to demand $5 million or more.

Industrial Inspections: Surveying something like a power plant or a major bridge might push the requirement even higher.

The best rule of thumb? Let your clients tell you what they need. Always ask for their insurance minimums before you even think about signing a contract. It protects both of you.

What Is the Process for Filing a Claim?

If an accident does happen, the process is usually pretty straightforward. The first thing you need to do is make sure everyone is safe. Then, document the scene—take photos, get witness information—but do not admit fault.

As soon as you can, get in touch with your insurance provider to report the incident. They’ll assign a claims adjuster who will walk you through everything. You'll need to submit your documentation and a formal claim form. From there, the adjuster will investigate what happened, assess the damages, and work on getting a settlement. The key to making the whole process go smoothly is quick, honest communication.

Ready to explore the skies with confidence? At JAB Drone, we provide the expert insights, reviews, and news you need to stay ahead in the world of drone technology. Whether you're a beginner or a seasoned pro, find everything you need at https://www.jabdrone.com.

Comments